Financial fraud is a high-stakes issue in banking, where schemes are becoming increasingly sophisticated and costly. As a result, detecting anomalies quickly and accurately is a top priority.

But traditional data-driven fraud detection models face challenges such as data scarcity, privacy constraints, and model bias. This is where synthetic data emerges as a powerful enabler for fraud detection at scale.

Synthetic data is AI-generated data that mimics the statistical properties of real-world datasets without exposing sensitive information. It offers financial institutions a way to train and test models more effectively while maintaining compliance and protecting privacy.

How synthetic data is changing the game

Fraud detection systems rely on large volumes of data to identify patterns and detect anomalies. However, real-world banking data is often constrained by stringent data protection laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). It’s also subject to compliance risks and access restrictions that limit its availability. Additionally, fraud is frequent and diverse, making it difficult to train models on the wide range of scenarios required. Collecting examples of all possible fraud types remains a significant challenge for banks.

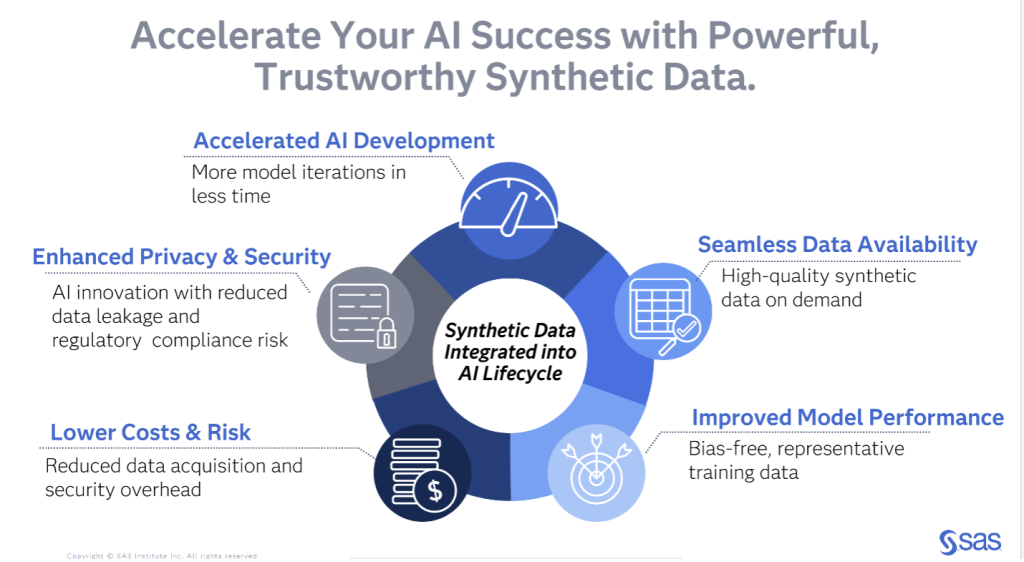

Synthetic data provides a powerful solution to these challenges, enabling banks to simulate a wide variety of fraud scenarios to train machine learning models more effectively. It addresses real-world constraints while supporting innovation in fraud detection.

Banks can realize multiple benefits from using synthetic data, including:

- Improved model training: Synthetic datasets can be engineered to include a higher proportion of fraud cases, helping to train more robust detection models. By oversampling rare events, banks can fine-tune algorithms to detect fraud more quickly and accurately.

- Privacy and compliance: Because synthetic data is artificially generated and contains no real customer information, it enables secure data sharing across internal teams and external partners. This facilitates collaboration and testing without compromising privacy or violating regulations.

- Faster, lower-cost development: Synthetic data can be created on demand, significantly reducing the time and costs associated with data collection, cleaning, anonymization, and compliance reviews. Generating datasets that mimic real transactions enables faster, more cost-effective AI development.

Key areas where synthetic data can improve banking operations include:

- Transaction monitoring to flag suspicious behavior.

- Customer onboarding to detect fraudulent accounts.

- Internal auditing to ensure compliance and accuracy.

- Secure third-party data sharing to enable collaboration without risking privacy.

Synthetic data allows financial institutions to better align fraud prevention with broader business goals while staying ahead of compliance demands. It enables innovation with reduced risk by allowing detection models or digital services to be tested in a safe, simulated environment before deployment.

Additionally, synthetic data reduces dependency on siloed data access processes, leading to faster time-to-value and accelerated innovation.

Keys to success: Talent, tools and governance

Before adopting synthetic data, financial institutions should invest in the right talent and tools to ensure teams are equipped with the necessary expertise. This includes building a foundation of data science, AI/ML engineering, governance, domain knowledge and platform capabilities. It’s also important to address key strategic questions up front and establish robust governance frameworks to ensure data quality, traceability and regulatory compliance.

Banks should start with high-impact use cases such as customer experience personalization, product development or credit scoring – all areas where synthetic data can deliver clear ROI.

Synthetic data is more than a privacy workaround – it’s a strategic asset. For banks navigating the dual pressures of fraud prevention and innovation, synthetic data fuels AI-driven fraud detection while safeguarding customer trust. Forward-looking institutions will embrace synthetic data to lead on innovation and detect fraud faster.